The Inside Story of the Plantation Palms Community and the Golf Club Sale

by Jim Hammond – A Resident

Bring Back Our Course – BBOC

It’s All About Property Values

Book 2: The Bill Place Era

- BOMB SHELL – The Government Rejects Bill Place’s Bid – Is it all Over Before it Even Starts?

This has NEVER been made public before! Bill Place, owner of Ace Golf, had actually made an official offer to buy the Plantation Palms Golf Course right before my first meeting with him on January 15th at Wentworth’s Mulligan, and almost 2 weeks before our 2016 Annual HOA Meeting “Shoot-out”. Keep in mind that the last failed offers the government had seen prior to his offer were in the $1+ million range, Bill’s offer was FAR short of this, it was such a low price that I won’t reveal here. This was weeks before the HOA meeting and I was hoping that the Annual Meeting would be a huge celebration, we would announce that the Golf Course, after being closed for almost 2 years, was now purchased by Bill Place. But as I’ve experienced throughout my business career, especially doing acquisitions of businesses, a deal isn’t done until it is DONE.

I was very concerned that the government had already given up hope on us, even though I was trying to keep in touch with them. I was also concerned that they would not like the bid submitted by Bill. So it was time to reconnect with them and push the Bill Place offer. Since Bill’s offer was quite a bit less that past numbers I had to use the only evidence I had that the golf course WAS NOT worth very much, it was time to use the Alan Cale report. It’s ironic that so many people on Facebook that were blasting me were also criticizing the HOA Board for wasting money on this report, thank goodness we had it, it turned out to be a key factor later in the government’s decision.

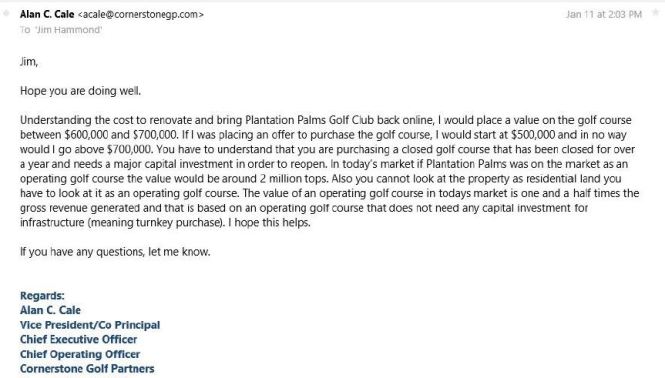

One thing the Alan Cale report did not provide at the time was a written estimate of how much he thought the golf course was actually worth. Therefore everyone had an opinion as to what it should sell for. It was pretty clear that the $1.2M asking price from MJS was not the number. So, I decided to go back to Alan Cale and ask for his professional opinion on what he thought, I wasn’t sure Alan would even respond, but he did.

Here is Alan’s email back to me with his estimate of the course.

This was great, we now had a 3rd party opinion using numbers in the $500,000 – $700,000 range for what the course was worth. I was now ready to get the government tuned into a whole new price range.

Here is a copy of an email I sent to all the key government players, seeking their support, remember at the time I was not a board member, just leader of the BBOC team.

——————————————————————————————————————————

Jim Hammond <jhammond48@yahoo.com>

To: Richard Berryhill, Michael Luger, David Johnson

Bcc: Rob Rochlin, Simon FitzPatrick, Bill Place

Jan 14, 2016 at 4:12 PM

Dear Messrs Johnson, Luger and Berryhill,

I represent a group of residents in Plantation Palms called the BBOC, “Bring Back Our Course”. Our group is supported by and has worked closely with our HOA Board to find a buyer for our golf course for quite some time. As the leader of the BBOC I have personally worked closely with Rob Rochlin for the past 9 months.

The BBOC has a bi-weekly newsletter with over 500 opt-in email participating resident, in addition, we have a dedicated web site with over 11,000 views by our 821 households since launching in August. Unfortunately since the course closed there have been multiple failed offers including most recent offers where the financial requirements to both buy the course and rehabilitate it far exceeded any potential business value of the course.

In August 2015 I presented to our HOA Board proposals to hire an independent 3rd party consultant to once and for all determine the true cost of rehabilitating the course. The Board selected and contracted with Alan Cale, CEO of Cornerstone Golf Partners to provide this independent analysis. The report was completed and delivered to the HOA Board within this last week. In a separate communication, we also asked Alan provide a realistic estimate of the value of the course, a potential purchase price. His reply was $500,000 – $700,000. This is on top of over $1.5M in rehab expenses plus cash flow required during the first few years of start-up.

We now understand that Mr. William Place, a well-known local operator of courses in our area, has made a cash offer to buy and rehab our course with no contingencies and an immediate close date. Mr. Place is by far the most qualified buyer we have had since this process has started. He has purchased and rehabilitated 3 local course in the last 10 years, all are well run and have great relationships with the local community. We would be proud to have Mr. Place as our community partner.

On behalf of our community, who have lived with a closed, distressed situation and falling property values for over 18 months we implore you, the decision makers, to accept Mr. Place’s offer and help this community Bring Back Our Course. This is a close community of families and retirees and the golf course is one of the central elements that bonds us together.

We look forward to the day we can again cherish the beauty of our property with an opened course.

I would be happy to answer any questions you might have and thank you so much for our consideration.

Jim Hammond

BBOC

————————————————————————————————————–

Jim Hammond <jhammond48@yahoo.com>

To: David Gunsteens, Ray Bedgood

Jan 14, 2016 at 4:19 PM

FYI, an offer to purchase the course was officially made today and provided to the BIA and MJS along with a conference call.

We are praying that it is accepted quickly and it could close around the time of the annual meeting. The BIA told Rob he might even have an answer tomorrow.

Tomorrow Simon and I are going on a tour of Bill Place’s golf course and meeting with the President of the Crescent Oak’s HOA.

I’ll let you know what I hear.

Jim Hammond

———————————————————————————————————-

On January 19th I learned that Bill’s offer had been rejected! It was a sad time, over before it started. See this email:

——————————————————————————————————-

From: Berryhill, Richard

Date: Tue, Jan 19, 2016 at 4:40 PM

Subject: DOJ

To: Rob Rochlin

Rob-

I did consult with David and we have decided not to accept the deal and refer the case to the Department of Justice. We do thank you for all of your assistance with this property.

Michael Berryhill, Eastern Zone Manager

Division of Capital Investment

Office of Indian Energy & Economic Development

————————————————————————————————————————-

Jim Hammond <jhammond48@yahoo.com>

To: Rob Rochlin

Jan 19, 2016 at 5:06 PM

Really sad, after all of your and our hard work!

————————————————————————————————————————

Rob Rochlin

To: Jim Hammond

Jan 19, 2016 at 5:10 PM

I’m really bummed. Thanks for all your efforts.

————————————————————————————————————————-

Jim Hammond <jhammond48@yahoo.com>

To: David Gunsteens, Ray Bedgood, Simon FitzPatrick,

Jan 19, 2016 at 5:32 PM

David, Ray and Simon,

It is truly a sad day in Plantation Palms.

At 4:40PM today we found out that Bills offer was rejected and the entire matter is being referred to the DOJ, meaning it is going into foreclosure. We were afraid all along that the level of frustration was mounting and the selling price dropping.

I’ll call David Johnson tomorrow if he’ll take my call just to chat.

I plan on doing a newsletter release and web site update tonight, then post a Facebook message.

I’d like to thank you all for all your effort, it has been quite a journey and we gave it a heck of an effort to the bitter end.

Jim Hammond

————————————————————————————————————————

THE DEAL IS DEAD, NO WHERE TO GO!

————————————————————————————————————————

Bill Place / Ace Golf

To: Rob Rochlin

Cc: Plantation Palms – Jim Hammond

Jan 20, 2016 at 9:34 AM

Hi Rob,

The HOA seems very motivated to help make this happen. Would you please contact the seller and ask what number would work for them? It may be that the community decides to make up the difference and get their golf course back.

Bill Place

President, Ace Golf

—————————————————————————————————————–

- The Idea of Community Participation – Really?

So, now you have it, it was becoming very clear that the golf course was NEVER going to come back without community “participation”. The financial numbers just wouldn’t support it. Read this as the community needs to pay some of the costs to Bring Back Our Course. How much could we pay, would the community go along with this? This again sounded similar to the Rocky concept where the community “participated”. It was also clearly shown in the financial model I had presented to the HOA Board 9 months earlier.

My personal opinion was that we could find a way to work out a deal, but just to be safe we needed to move forward along 3 separate fronts, Bill Place buying the course with our “participation”, Penny Parks – Links Financial, housing development and Alan Cale’s proposal to have the HOA buy the course. Bill knew that we were facing tough decisions and was doing everything he could to help us through it. The HOA Annual Meeting was only 2 days away and we had just met with Penny.

At the same time we got some bad news. Remember the idea of a “carve out” of the driving range to build some houses, this was to help Bill finance the purchase of the golf course. Well Bill had called me to say that he had access to an engineering report that showed the driving range had “spongy soil” and would need major surgery and a large amount of new dirt, the “carve out” was no longer a viable option. Good quality fill dirt in this quantity is almost impossible to find and the cost would be prohibited. With no carve-out Bill was not going to get the money that he was counting on to buy the course. By the way, he used a similar situation when he bought Pebble Creek many years ago.

Here is an email from Bill trying to frame the discussion:

—————————————————————————————————————————

Bill Place

To: Jim Hammond, Simon FitzPatrick, David Gunsteens

Jan 22, 2016 at 12:04 PM

Hi Guys,

I’ve been giving this some more thought and have a few things to share.

It is still hard to imagine a scenario with any residential development that you would not have most of those that live on the golf course opposing any kind of development despite what the HOA might support. They would just be losing too much equity. There are enough of them that it would make any re-zoning a crap shoot at best. My experience is that commissioners cave to angry voters.

I still don’t have any further indications on the carve out. I would still hope that even with all the fill there might be something to gain, though if it were too small, it would be best to keep the driving range anyhow. I wish the soil information were different. Are there any other parcels that might work, even for a home site or two? That would raise some money.

If you opt for the course renovation, I really don’t know if the seller would go for a bid $50-100k higher. They may still go to foreclosure, and if builders understand that a re-zoning is not very likely, it may be possible to get the course at a lower price while wiping out past liens. Possibly a better option, though with some more risks.

I’ve thrown out numbers to you based on my experience. If we can get to the sales price they need, perhaps it is easier ongoing if you were able to get a $100/home annual beautification fee for 5 years or $80 at 6 years. If I can get the course profitable and making debt service sooner, perhaps there could be a clause to reduce the fee at certain triggers. A course needs to be producing $200k/year ebida to be minimally profitable and making debt service; $300k would be considered a healthy business. These may sound like high numbers, but you have to take in to account that at least $50k year in capital expenses reduce these numbers further – we must invest in the course and facilities every year.

Our view of a golf club is as a community center. We offer kids clubs for after school golf lessons, social events, meeting rooms for card players and classes (this would be in the divided section of the restaurant), party/wedding facilities, community picnics, and of course, restaurant service 7 days/week.

Anyhow, just some thoughts. If I can be of help, please let me know.

Bill Place

President, Ace Golf

————————————————————————————————————————

You will note in Bill’s email the mention of a “beautification fee”, this was an idea I floated out after a discussion with a board member as a possible way to get money from the HOA. It was more or less a “placeholder” idea until we could figure out a legal way to “participate”. OK, now it’s time for the January 26th big meeting. We’ll sort out all the details later!

- The Big “Shoot-out”, January 26, 2016 Annual Meeting & Board Elections

So, we are all ready for the big event that will help set the strategic direction of Plantation Palms as a community. Will the BBOC (Bring Back Our Course) Board Candidates consisting of Simon Fitzpatrick, Jeff Steiner and I get elected onto the HOA Board? What will the reaction be by the community to our 3 Guest Speakers that evening, each proposing a different course for our future? The HOA Board had hired an off-duty sheriff for the night, just in case. The church where we held the meeting had a large turn-out, well over 250 people.

Let’s look at the 3 speakers, first Penny Parks from Links Financial. As I mentioned in Book #1, on January 21, 2016, a week before the board meeting Simon and I met with Penny and her team. Here is a copy of my report from that meeting, click here. We went to Links to try and test the waters for an “agreement” of sorts that would provide the Plantation Palms community with certain amenities and considerations in trade for helping support any zoning changes required to build houses on the closed golf course. This of course was a back-up plan to re-opening the course. Penny made it clear that she supported the idea of re-opening the club, if it was possible. Penny knew that she might have a hostile crowd at the Annual HOA Meeting, we suggested that she consider offering some of the amenities I provided to her in writing on our January 21st meeting. Since we did not want to reveal who the other guest speakers would be we actually kept Penny, Bill Place and Alan Cale in separate rooms at the church where the meeting was help. By the end of the night Bill Place and Penny Parks had met up in the lobby and were chatting. It turned out that Bill’s wife, Su Lee Place, had known Penny from various Tampa area social/fund raising events. Both were well known in the community, the secret was out!

Here is one of many emails that I was generating every day regarding the golf course and upcoming HOA Board elections.

Jim Hammond <jhammond48@yahoo.com>

To: Rob Rochlin

Jan 20, 2016 at 2:29 PM

Hi Rob,

I’ll just quickly boil down where we are at from a community point of view. Today I have consulted with our HOA board president, other board members and key people in our community. We will immediately begin serious discussions with the land developer who is prepared to confirm their offer to immediately purchase the Plantation Palms property as a housing development with assurances from the community that we will provide best efforts not to oppose any rezoning restrictions as they might come up at a later date.

Our pressing issue is that we have our Annual Homeowners Meeting and board elections taking place Tuesday evening, January 26th. We are working with our HOA attorney as I write this email to prepare us for how to update the community at this meeting on our potential plans to “partner” with a developer. I am confirming a meeting with this developer for tomorrow afternoon, January 21st to further clarify our potential partnership.

Our goal is to have all of this worked out next week after our Annual Meeting so that the land developer confirms their offer and can immediately close on the deal.

The BBOC group is working very hard to make this happen well prior to any foreclosure or tax deed sale that we all fear.

Please let me know if you have any questions.

Jim Hammond

Founder, BBOC

———————————————————————————————————-

Just to keep life interesting, while I was in the thick of all of this I had another inquiry by a potential golf course buyer. I got a call from Chris McLaren, Firinn Golf Group managing partner, who had just bought Pine Lakes Golf Club, Palm Coast, FL in October 2014, they already owned Regent Park Golf Club, near Charlotte, North Carolina. Chris indicated that they were in the early phases of looking for another course and would need a number of months of just due diligence, before an offer could even be made. I explained to Chris that we had an offer from Bill Place for immediate purchase, he understood and I kept his name handy just in case. I passed all of this information along to Rob Rochlin. In addition, I sent an email introducing Chris to my friends at Turkey Creek who were still looking to re-open their course.

————————————————————————————————————

Let’s get back to the “big shoot-out”.

Penny Parks was first up on the podium and along with Mike Lawrence, a developer, gave a good presentation about how Links Financial could, if a golf course buyer could not found, provide a high quality housing development. They presented the idea of purchasing the Plantation Palms Golf Course property and building houses on various portions of the land. They provided an engineering drawing of houses, lakes and streets. They indicated that the houses would be equivalent of our Savana neighborhood. This plan included the complete removal of the existing club house. The entire project would be based upon strong community support for zoning approval. The development project along with various studies alone would take about 1 year at which time a builder could start building on lots. It was unclear exactly how many lots were being proposed and construction could take 3-5 years or more depending on sales. Penny indicated that at the end of the project, they would deed over to the HOA at no charge all remaining segments of land they were unable to develop on and the HOA would then maintain this land and it could use it for walking trails etc. Again, this was not what the group wanted to hear, but the homeowners were respectful. The disappointing part to me was that after providing Penny with a list of community sought after amenities and considerations (in my opinion), the only accommodation she identified in her presentation was the deeding to the community of a dozen tax parcels that were two small or narrow to develop on. This was a no-brainer anyhow, no one outside of the community could use these parcels and the cost to maintain them was not cheap. Not a good sign, we were hoping for more amenities. We believed at the time that Penny Parks had already had a discussion with Rob Rochlin, the club’s real estate agent, about putting in a bid for the course for about $1M. We don’t believe this bid was ever formalized or sent to MJS.

Alan Cale was next up to the podium. Alan was Chief Executive Officer – Cornerstone Golf Partners. If you remember from Book #1, Alan had been hired by the HOA Board to do an analysis of the golf club: was it a viable opportunity, what would it cost to operate it and so forth. In other words, Alan was going to present why the HOA should buy the club and hire his company to manage it. By this time only a few people on the HOA Board had even seen the report, (I’m not sure if any board members actually had read it.) As mentioned in Book #1, I had been given a copy of the report, less Alan’s price quote pages for his services. I had read every page of this report, and knew it well. I had already developed a list of concerns with his financial modeling, I felt there were huge gaps in his numbers. I had already given some thought and did a little research on how a Florida non-profit HOA could “buy” a golf course, what would the legal structure be. There were some options on how to do this with a separate LLC. So, Alan gave his presentation to the meeting and there was a mild level of interest, at least the community would have a golf course. Also as I mentioned in Book #1, Alan’s basic operating numbers were similar to the financial model I had presented at both the Land Study Committee and the HOA board in 2015. After Alan’s presentation the HOA Board allowed for short question & answer session for homeowners. A critical question was “in total, how much money would the HOA need to come up with make his plan work”? Alan struggled with this, he wasn’t exactly a finance guy, but he finally said it would cost about $3 million. I already knew the answer to this but Alan needed to tell all the homeowners. That was pretty much it, few people in the room wanted to hear a number like this. I would, at a later HOA homeowners meeting, dissect these costs and explain them in more detail. The number was pretty close to the real cost.

Bill Place was the final speaker, and the one most homeowners wanted to hear . Bill and his wife Su Lee are Tampa residents who owned existing golf clubs, Pebble Creek, Crescent Oaks and Wentworth. They also own Ace Golf driving ranges, miniature golf and batting cages and the Mulligan’s brand of restaurants. Bill told the meeting he would like to buy Plantation Palms Golf Course and make it into a top notch facility. He had 23 years of golf owner/operator experience, but wasn’t a golfer. He was a business man. The 3 golf courses he owned all required substantial renovations after being purchased. Crescent Oaks was similar to Plantation Palms, closed for a year or so. Bill explained that he would put in a family themed restaurant; I had been to both of his Mulligan’s pubs and they would fit nice in our community. He also made it clear that the economics of buying our course were not good and he would need community participation to help fund the costs. He indicated that the rehab alone would cost him about $1.5 M, in addition to the purchase price and cash flow requirements. All of his current golf courses became profitable after 3-4 years. What wasn’t mentioned was Bill was counting on getting about $800,000 from the “carve out” of the driving range for residential development. Click here to see a copy of Bill’s presentation at the 2016 Homeowners Meeting.

Here is a copy of the Flyer Bill had made up for the event, click here.

A Straw Poll. At the end of the 3 presentations Eric Appleton, the HOA attorney, asked the meeting attendees for a raising of a hand, straw poll, not legally binding, but a show of support for one of the 3 options presented. The voting was surprising, about 6 people voted for a housing development, a few more for the HOA to buy the course, and the vast majority went for Bill Place buying the course. The surprise was that there were 6 people who wanted a housing development, maybe I shouldn’t have been surprised, I was getting “rocked” on our community Facebook site by a handful of people who continually attacked me and the BBOC.

Tax Deed Sale. At our January 26th meeting, Eric Appleton explained the issue regarding the potential Tax Deed Sale of the golf course for past due taxes to Pasco County. This was a critical issue. I’ll cover this in more detail later, it was one of the most controversial issues that divided the community throughout the entire golf course sale process.

Election Results. It was probably not a surprise that the BBOC team running for election, was swept into office by a pretty wide margin, here was the final vote count for 3 new HOA Board Members:

Simon Fitzpartick – 156 – Elected

Jim Hammond – 145 – Elected

Jeff Steiner – 128 – Elected

Ana Vazquez – 113

David Schwarz – 105

Jewel Aardema – 94

After the Annual Meeting I wanted to reach out to Penny Parks, who was so professional throughout the entire process, so we exchanged emails, see below:

—————————————————————————————————————-

Jim Hammond <jhammond48@yahoo.com>

To: Penny Parks

Jan 27, 2016 at 10:49 AM

Hi Penny,

First off I want to thank Mike and you for taking time to address our residents who attended the Annual Meeting last night. You had a very difficult proposal to make and I thought you did a very good job of presenting your plans.

Just as an update to what transpired last night, the 3 BBOC candidates running for the board were all elected, including Simon and me. We will be seated shortly as we have our first organizational meeting.

Secondly, we also had presentations from a proposed local golf course buyer, and a proposal from a 3rd party consultant hired by the board to explain the costs to the community to outright purchase golf course ourselves. After all the presentations, Eric, our HOA lawyer, asked for a non-binding straw poll of attendees as to which of the 3 proposals looked most attractive. Your housing development proposal received about 6 votes, the purchase of the course directly by the HOA a few more votes, and the purchase of the course by the local buyer (including the requirement for community assistance) had an overwhelming display of support. The results of the straw poll was clear, I guess this may have been expected.

So at this point we believe the community wants us to proceed with further discussions with the local golf course buyer. Frankly, with the low vote count for the proposed housing development and the noticeable grumbling about opposing any such attempt I personally don’t feel at all comfortable at this point that the community would support any housing option. Again I’ll make it clear that I am not providing this communication as a board member, nor necessarily representing the opinion of the in-coming board, I speaking as a private resident.

Again I want to thank you for spending time with Simon and me and addressing our community.

We never know what the future holds and it was a please meeting with Mike and you.

Jim Hammond

———————————————————————————————————-

Penny Parks

To: Jim Hammond

Jan 27, 2016 at 5:46 PM

Jim – thanks so much for your GREAT report! Well said – but then in having worked with you I’m not surprised!

When I saw Bill Place I had a feeling that you all were going to try to keep it as a golf course. I really hope that works for you all.

Thanks for all of the time that you gave to Mike and me – I really appreciate it. Glad you’ve joined the board – I’m sure that you and Simon will do a great job!

All the best – Penny

Penny Parks

Links Financial, LLC

——————————————————————————————————————————

On January 29, 2016 I provided the entire community with a newsletter update from the HOA Annual Meeting. Those not in attendance were delighted with the outcome.

I would not officially be on the HOA Board until the “organizational” HOA meeting set for Tuesday, February 2nd at noon, at that meeting I would both become a board member and be voted to become Vice President of the HOA.

- January 27, 2016 Another Crisis with the Government – “Ticking Time Bomb” – 4 PM Impossible Deadline

Just when you thing you can chill out for a few days, especially after last night’s Annual HOA Meeting, all hell breaks loose the following morning. I needed a break, but it was not going to happen, things would get much worse.

Bill Place’s prior bid to buy the golf course had been rejected as too low as I mentioned above. Bill then turned around and made a higher bid to buy the course with a contingency that the Plantation Palms community provide a level of funding. No funding, no deal! The government had this latest bid; we however had no plan on how to come up with the community participation money.

At 11 AM the morning after the Annual Meeting, I got a surprise call from Rob Rochlin, he had Richard Berryhill from the Bureau of Indian Affairs on the line, and we would have a conference call, SURPRISE. The call was a total disaster, Berryhill was highly agitated and told us we had until 4 PM that day, January 27, 2016 to provide a letter saying we had completely resolved the “community contingency” funding issue with Bill Place’s offer. Furthermore, Berryhill did not take seriously a letter that Eric Appleton (HOA attorney) had sent to the government about the pending “tax deed” sale. You’ll see Berryhills comment about the DOJ laughed at the letter. I can tell you right now that the DOJ was NOT laughing at the “tax deed” issue a month later.

That was all I needed to hear, after having spent over 1,000 hours working on this crazy project, I was totally pissed! As professional as I could be under this pressure I let Berryhill have it, we weren’t going to back away from this deal now! We had a real buyer, Bill Place, we just needed to work out a few small matters, like MONEY!

———————————————————————————————————————–

Jim Hammond <jhammond48@yahoo.com>

To: Ray Bedgood

Cc: Simon FitzPatrick

Jan 27, 2016 at 11:53 AM

Ray,

Can you pass this along to Eric, I don’t have his email address?

I just got off a joint call with Rob Rochlin and Richard Berryhill from the BIA regarding our golf course. He says that we have until 4PM today to provide a letter proving we have a deal to buy the course, Bill’s offer for approx.$1M. I told Richard all the details about our annual meeting, new board, strong support for Bill’s deal, the need to seat the board and get a community vote. I also mentioned a huge political campaign based on the facts presented to us by Eric regarding the tax deed sale. His comments was that the DOJ guys “laughed” at the letter. I told him that we too are tax payers and didn’t think it was a laughing matter.

I told him clearly that this community needed a reasonable period of time to complete the transaction.

I made it clear that NOTHING would be happening by 4 PM today other than a statement of our intentions and a request, given the new developments, for additional time to solidify the offer.

This is a real pain

Jim-

————————————————————————————————————————–

Ok, it’s now noon and emails and phone calls are flying around, we needed to get this under control, it was getting ugly. We agreed that Rob and Bill had to call the government, I was in NO mood to be on that call. This time they called another person involved at the BIA, Mike Lugar. Here is that email:

————————————————————————————————————————–

Bill Place

To: Jim Hammond

Cc: Ray Bedgood, Simon FitzPatrick

Jan 27, 2016 at 1:24 PM

Rob and I spoke with Michael at BIA. I told them the $1M offer would NEVER close, that the HOA may supplement my offer, but to expect $1M is not reasonable and would unfairly deplete HOA reserves. Told them they needed to tell a minimum they would accept and get this done.

——————————————————————————————————————————-

Bill’s email generated more calls and emails. We needed a strategy to again get this whole project under control. It was time to take a step back and re-frame the entire discussion with the government and present a united front. It was time to get the “boss” at the government back involved, David Johnson. It was decided that I would provide a detailed email to all the parties, including the government with a proposed step forward. In addition, the government needed to take the tax deed issue seriously.

Unfortunately I used the word “Ticking Time Bomb” in my government email!

—————————————————————————————————————————

Subject: Plantation Palms Golf Course Community and The Ticking Time Bomb

From: Jim Hammond <jhammond48@yahoo.com>

To: David Johnson, Richard Berryhill, Michael Luger

Cc: Bill Place, Ray Bedgood

Bcc: Simon FitzPatrick, Rob Rochlin, New HOA Board

Jan 27, 2016 at 4:10 PM

Dear Messrs.’ Johnson, Luger and Berryhill,

I last wrote to you on January 14, 2016 regarding our efforts to secure a buyer for our golf course.

Today in discussions with Mr. Berryhill, we were told that we had until 4PM ET today to provide an executed agreement between both our buyer and MJS, the sellers. Mr. Berryhill further indicated that our property had already been turned over to the Department of Justice to handle this property under foreclosure and furthermore, deal with the “ticking time bomb” which is the many years of unpaid property taxes on the two main golf course parcels that are scheduled to go to Tax Deed sale shortly in Pasco County Florida.

Gentlemen, it is impossible for us to consummate this transaction by 4PM today.

As I indicated in my past correspondence we now have a highly qualified buyer Mr. William Place who is prepared to make a cash offer to purchase the course for $900,000, far above market price. Mr. Place’s offer is based upon our HOA agreeing to subsidize a portion of that selling price, for which we have the cash to do so. At last night’s Annual HOA Meeting Mr. Place presented his plan to the community and was given a strong show of hands supporting the proposal. Our HOA rules require us to put this expenditure to a vote and achieve a certain level of confirmation from the homeowners. We are in the process of organizing that effort as I write this letter. Due to official notice requirements and so forth we expect to have a community confirmation that our board can then approve, thus allowing Mr. Place to proceed with his offer and immediate close on the property. We believe all of this can transact before a Tax Deed sale takes place.

We are asking for an extension of time to allow our community to complete our process and save us all from the unknowns of a foreclosure and potential further delays in bring back our property values and the serenity our community deserves.

As a point of clarification, I am providing a list of our current HOA Board members and our HOA attorney. I am providing this since these are the only people authorized to speak on behalf of the HOA. We may have individual residents who may contact you with their personal beliefs, we have no control over them. The people below represent the entire community.

Ray Bedgood

Simon Fitzpatrick

Laurann Flynn

Jim Hammond

Tim Hodes

Keith Rodrigues

Jeff Steiner Eric Appleton, ESQ, Bush Ross, the HOA attorney

We again implore you to allow us to bring back our golf course that has been closed for almost 2 years. We believe we are very close to a final resolution.

If you have any questions please do not hesitate to contact me directly at 813-388-2833

Thank you for your understanding of our situation.

Jim Hammond

Plantation Palms HOA Board Member

——————————————————————————————————————

OK, the email went out and I needed a drink! Maybe I could enjoy a nice dinner out with Diane (my wife).

No, not tonight! Within 2 hours we had a detailed response directly from David Johnson. This became a somewhat famous email and a few lessons learned.

Lesson #1: DO NOT send an email to a high level government figure with “Ticking Time Bomb” in the subject line, oops! My mistake, but it did get immediate attention.

Lesson #2: “Trains and Planes and Collection efforts have to live with timetables”. I took this that David Johnson had a real sense of humor.

Here is the email:

———————————————————————————————————————

From: Johnson, David

Sent: Wednesday, January 27, 2016 5:46 PM

To: Jim Hammond <jhammond48@yahoo.com>

Cc: Richard Berryhill; Michael Luger; Bill Place ; Ray Bedgood

Subject: Re: Plantation Palms Golf Course Community

Greetings Mr. Hammond,

As a taxpayer, you’ll appreciate that our program used some of your money to reimburse the original lender for this project. We have been trying for close to two years to start the process of getting those funds repaid on your behalf. From information conveyed to Mr. Berryhill and his predecessors, we’ve been told of multiple opportunities for the debtors, who still own the golf course, to enter into a voluntary sale of the property to do just that. After an approved sale, they would send the proceeds to us, and we then could determine what to do about any amount still owed. But without exception, each of these sale proposals has fallen through.

My Division does not drive this process; the sellers and the universe of buyers do. We merely have veto power over any agreement reached.

We are now way overdue elevating this debt in accordance with Federal guidelines, thanks to an extraordinary string of false starts. Since there is valuable collateral — although, as you say, its value has declined over time due to lack of maintenance and a deepening tax problem — what we need to do is transfer this debt and its collateral to the Department of Justice (DOJ), the government’s law firm. I have asked Mr. Berryhill to do that without further delay. DOJ will then start helping us design a comprehensive debt collection strategy, including foreclosure.

Even when DOJ is in control of further collection efforts, however, we still can consider anything sensible we or they can do to collect amounts owed. We are merely getting DOJ involved because it is that organization, not us, who can use the court system to assure we make progress.

I am not a fan of artificial deadlines, but trains and planes and collection efforts have to live with timetables. What you wish to have happen, perhaps, still can. Mr. Berryhill simply has to know what information to put into the paperwork he is submitting to DOJ, and since there’s no pending, signed deal, that has to be reflected in his submission.

You may well reach an agreement involving MJS, Mr. Place and the HOA sometime after today. Submit it to us when you do, and we will forward it to DOJ for discussion. If it is sensible, we may still go that route. Foreclosure takes a while, and we have not begun the process yet.

In the future, please note that Mike Luger is no longer involved in this matter; you may leave him off any further correspondence. Also, please consider that you have a very security-conscious government these days. You may wish to avoid subject lines like the one you picked this time.

Best wishes,

David B. Johnson

Acting Chief, Division of Capital Investment

Office of Indian Energy and Economic Development

U.S. Department of the Interior

——————————————————————————————————————————–

Well, you can’t read this email without concluding that David Johnson himself had already gone all the way he could to help out our community. Furthermore, after all of this time, he was still sympathetic to our efforts and was AGAIN giving us the opportunity to come back to him or the DOJ with a deal.

After reading this email I was again inspired to push forward, we would not “screw” this up, we just need to come up with a few hundred thousand dollars! Time for that drink!!!

- ACE Golf Asks for Money – How Do We Get a Few Hundred Thousand Dollars?

Let’s get serious here, how to we come up with this money? The following morning on January 28th, I started working pretty much full-time working on getting money. I once asked Bill if he was willing to take on a silent partner(s) who would come up with this money. He flatly rejected the idea, no partners.

I guessed that even though the new HOA Board had not even officially met yet for our “organizational meeting”, it was OK for me to start speaking for the new Board, I mean I was elected 2 days ago!

The first step in looking at HOA provided funds was to get an official request from Bill Place, up until now all we had were emails to a non-board member (me up until 2 days ago). I sent the following email to get the process started.

Oh, and did I fail to mention that all during this time I was still getting blasted on Facebook almost daily by the same 8-10 people who were anti-BBOC. Luckily I kept getting encouragement from Simon Fitzpatrick and others to try and ignore these jerky people. I was now on the HOA Board, did I still have to take this crap …. Yep!

———————————————————————————————————————————

Subject: Plantation Palms Golf Course – Bill Place

From: Jim Hammond <jhammond48@yahoo.com>

To: Bill Place

Cc: Ray Bedgood, Simon FitzPatrick

Jan 28, 2016 at 11:49 AM

Bill,

In order for the HOA Board consider a request for funds we will need a formal request from you with some general details of the specific requests. This should be sent to the HOA Board via either letter on a business letterhead, or via email with your business logo enclosed.

The request should identify specifically what the funds would be used for, etc. If the HOA Board decides to act on your request a legal agreement can then be drafted.

Your request should include at least these items:

- The name of the person or entity requesting the funds. We may want to pay funds to the actual entity purchasing the course.

- Identify what the funds will be used for, i.e. purchase of golf course and rehab of golf course.

- Clarify that any funds provided by the HOA would be a contribution, not a loan, nor purchase of any equity position, now will it be paid back.

- Identify the amount requested for the purchase, i.e. not to exceed $300,000, and date due, i.e. xxxx days after proof of transaction closing and clear title.

- Identify the amount requested for the renovation of the property and club house, i.e. not to exceed $100,000 per year for xx years. Identify when these payments would be due i.e. payable in 2 – 6 month payments.

- Identify in general terms any offsets to the renovation payment requests, i.e. EBITDA exceeding $xxxx/yr, if any property on the course is sold to a developer, if any other business is set up ie miniature golf etc.

You are welcome to provide this in email format to both Ray Bedgood and me. We have a meeting scheduled for Tuesday, February 2 at noon. Can you get this provided to us before our meeting?

Jim Hammond

———————————————————————————————————————–

Bill Place / Ace Golf

To: Jim Hammond

Cc: Ray Bedgood, Simon FitzPatrick

Jan 28, 2016 at 1:21 PM

Yes, that won’t be a problem. Thanks for all the specifics.

———————————————————————————————————————-

On January 31st, Bill Place provided his formal proposal to the HOA as a framework as to how we might do a deal. Here is a copy of the first email, to save you some time, I can tell you that we had a number of back and forth emails and discussions to get his proposal into something that I could pass along to the new HOA Board to even begin a discussion. Here is the email string, and the final Bill Place Proposal.

————————————————————————————————————————

Bill Place / Ace Golf

To: ‘Jim Hammond’

Cc: ‘Ray Bedgood’ ‘Simon FitzPatrick’

Jan 31, 2016 at 7:47 PM

Hi Jim,

Here you go. Please let me know any comments, suggestions.

Thanks,

Bill Place

President, Ace Golf

———————————————————————————————————————

Jim Hammond <jhammond48@yahoo.com>

To: Bill Place / Ace Golf

Cc: ‘Ray Bedgood’ ‘Simon FitzPatrick’

Jan 31, 2016 at 9:12 PM

Bill,

Thanks for the proposal.

Here are a couple of comments.

- The board will consider your proposal, subject an agreement between the parties drafted by an attorney along the lines of your proposal. We’ll have our attorney review it and provide the HOA Board final approval. Please add a line in your proposal, “to a legal agreement” being reached.

- You identify the “minimum” amount required by the HOA to be $300k based on a $1M selling price, We need this changed to read a “maximum”. You may want to state your bid to the sellers that you bid is an “all in” bid and the maximum price to include all costs, liens, taxes etc….. In other words we don’t want to spend over $300K towards the purchase, this of course would be offset as you mentioned by and price reduction below $1M, like ay $900k.

- We ask the attorneys to provide language as to what happens if the purchase is made and the course doesn’t get renovated etc.

- Under the club house we’d like to see a reference to a restaurant/bar similar in menu and theme to Mulligans, so we have a frame of reference as to what we can expect.

We have a special board meeting on Tuesday where we will discuss your proposal, the idea is that we would seek community approval, as required by our HOA bylaws, along the lines of the “not to exceed $xxxx” so as to give the board the flexibility required to complete a transactions, if so approved.

If the above are acceptable to you please make the changes and return your proposal. If you’d to discuss any details I’m available anytime tomorrow after 10AM or so.

Thanks,

Jim-

————————————————————————————————————————–

Here is a copy of the initial ACE Golf request for Community “Participation”, it totaled $800,000. This of course was round 1 of the entire process, but at least we had a written request. Click here to see the ACE Golf January 31, 2016 proposal.

I won’t mention any names, but these emails were already generating some flak from a board member who felt I was way out of bounds to already be speaking for the HOA Board. I had been leading this entire effort for the last 9 months, so I’m ruffling a few feathers, I’m on a mission and I’m sure not letting up now! The mission was to Bring Back Our Course!

- February 2, 2016 – My First Board Meeting as a Director

The 2016 HOA Board meet for its organizational meeting to appoint officers at Noon on February 2, 2016. At that very first meeting I was elected Vice-President of the HOA, Tim Hodes was elected President. Ray Bedgood, who had been Vice President on the previous board, withdrew his name for consideration and announced that he would probably be moving from the community in 2016.

Just as soon as the elections were done it was time to get down to business regarding the golf course. Based on previous discussions with board members here are the actual recorded minutes from the meeting. We need to move quickly to deal with the pending Tax Deed sale issue and Bill Places offer. We need to call a “special Membership Meeting” of all homeowners ASAP. Keep in mind that in the past the only Membership Meeting ever called was the annual meeting in January, that was about to change.

Recorded Board Notes:

Membership Meeting – Laurann Flynn made a motion to have a membership meeting and call

for a vote to use up to $150,000 if necessary to pay the taxes on the golf course parcels. Jeff

Steiner seconded the motion and all directors voted in favor.

Golf Course – Jim Hammond made a motion that the Board authorize a community vote asking

for the authority for the Board of Directors to assess and award funds not to exceed $800,000 to

assist a private buyer in the purchase and renovation of the Plantation Palms Golf Course and

Club House. Simon Fitzgerald seconded the motion, Ray Bedgood abstained and all other

directors voted in favor.

Laurann Flynn made a motion to include a vote on the proxy asking residents if they would be in

favor of a residential development of the golf course – at no cost to residents. Jim Hammond

seconded the motion. Ray Bedgood abstained and all other directors voted in favor.

- Other Golf Course buyers shows up – Are you kidding?

Just when you think you have things settled down the unexpected seems to happen. I had just gotten in the mail a Pasco County summons for jury duty and had been scheduled for jury selection on Monday, February 8th. Are you kidding, I’m too busy to deal with this. Luckily when I called on Sunday evening February 7th I found that I did not have to show up, thank God!

However, that week was even a little more exciting when two more potential new golf course buyers showed up on the scene. Here are some of the emails that will tell the story.

Davey Golf Inquiry:

——————————————————————————————————————————-

Jim Hammond <jhammond48@yahoo.com>

To: lincoln.adams@davey.com

Feb 3, 2016 at 8:52 AM

Lincoln,

We met during the Plantation Palms special board meeting yesterday.

You indicated that your company might have interest in our golf course. We are really late in the game with a proposed buyer, a tax deed sale looming and a foreclosure process underway. the property is available today under a short-sale.

If you have someone who is high enough in the organization to make quick decisions I can share some facts with him/her, including a 3rd party consulting study on the cost of rehab.

If I don’t hear from anyone I’ll assume it is a pass.

Thanks,

Jim Hammond

————————————————————————————————————————-

Adams, Lincoln <Lincoln.Adams@davey.com>

To: jhammond48@yahoo.com

Feb 3, 2016 at 9:26 AM

Jim,

I have sent all the information that a gathered at the meeting to the RIGHT people. I am doing everything I can to help save the golf course which is obviously very important to the neighborhood and surrounding community. I will have an answer back soon and pass it along to you.

Typically Davey Golf manages courses. We don’t own any currently. A few of us within the company are working to change that.

I will keep you posted as it comes down.

Thanks

Lincoln Adams BDM

———————————————————————————————————————–

Jim Hammond <jhammond48@yahoo.com>

To: mark.jackson

Feb 3, 2016 at 12:27 PM

Hi Mark,

I have been involved with our community to help find a buy for our community golf course, Plantation Palms Golf Club, Land O Lakes FL for the past 9 months. The course has been closed for the last 18 months.

If you are interested in learning more you can contact me at 813-388-2833. We are on a very tight time frame with a pending buyer, a possible foreclosure and tax deed sale pending.

Jim Hammond

————————————————————————————————————————–

Jackson, Mark

To: jhammond48@yahoo.com

Cc: Lincoln.Adams@davey.com

Feb 3, 2016 at 1:27 PM

I will contact you in the next 24 Hrs. to discuss how we may be able to amicably work together.

Thanks, Mark Jackson

——————————————————————————————————————————–

I won’t publish anymore correspondence because after talking to Davey Golf on the phone they were in no way able to move quickly to make an offer on the course and they could clearly see that we already had a good buyer we were working with.

Green Golf Partners Inquiry:

——————————————————————————————————————————-

Dave Esler

To: jhammond48@yahoo.com

Feb 19, 2016 at 5:15 PM

Jim,

I appreciate you taking the time to chat with me today regarding the Plantation Palms Golf Course. The situation is most unfortunate for the residents, but we are hopeful that we may work together to turn things around.

My partner and I partially inspected the site earlier this week and came away thinking that it was worth further investigating, particularly because the surrounding real estate presents so well. The residents are clearly to be applauded in such a challenging situation. As I’m sure you are acutely aware, these can be complicated deals, but we are prepared to spend some time working through the due diligence process to find a mutually beneficial way forward for the golf course and the HOA.

Please feel free to put us in contact with your listing agent or anyone else you may feel is useful for us to speak with. I understand that you may have an offer of some type already, but we both know how difficult it can be to actually close a sale. If it is possible, we would like to review the course assessment by Mr. Cale at Cornerstone Golf Partners. We will, of course, be discreet.

Again thank you for your candor in speaking with me today. I look forward to possibly meeting up with you in the next couple weeks.

Dave

David A. Esler, President

Esler Golf Designs, LLC

Vintage Golf Construction, LLC

EMGG, LLC

———————————————————————————————————————————

Dave Esler

To: Rob Rochlin, Matt McIntee

Cc: jhammond48@yahoo.com

Feb 29, 2016 at 12:46 PM

Rob,

Thanks for the call this morning, sounds very much like time is of the essence.

By way of this email, please meet my partner, Matt McIntee. His cell is (xxx) xxx-xxxx, his email is above. He is very familiar with the Tampa market. It is, of course, easiest if the two/three of you speak directly about setting up a time to meet this week. I am assuming that it will be Wednesday, but that’s up to you all.

Matt, please also meet Jim Hammond, his cell is (xxx) xxx-xxxx. Jim is the current VP of the Plantation Palms HOA. I was directed to Jim from the previous President of the HOA. I think it is important that you connect with Jim as we both know that the participation and cooperation of the HOA is critical to making this work – if that is at all possible.

Rob, if you could please provide a brief bullet point summary of who all is involved and the schedule as you know it, that might also be helpful.

I look forward to speaking with you all again soon.

Thanks, Dave

————————————————————————————————————————————

I won’t publish any more of these emails, there were dozens of back and forth communications. These to me were just more distractions. We had a buyer, a draft Services Agreement and a “Ticking Time Bomb”.

At this point we are again going 100 miles per hour, trying to get a deal put together with Bill Place. Even though we didn’t have all details worked out.

I needed to update the government on what was happening, I couldn’t let them just drift along, processing our course for foreclosure.

Here was my email update to them:

————————————————————————————————————

Subject: Plantation Palms Golf Course – Follow-up

Jim Hammond <jhammond48@yahoo.com>

To: David Johnson

Cc: Richard Berryhill

Bcc: Bill Place, Tim Hodes, Eric N. Appleton, Simon FitzPatrick, Ray Bedgood, and 5 more…

Feb 4, 2016 at 7:55 PM

Mr. Johnson,

I thought it would be appropriate to follow up to your email of January 27, 2016, since a lot has happened in our community in the last 10 days

At our January 26th Annual Homeowners Meeting, I was elected to the HOA Board along with two others who were very supportive of our golf course efforts. Subsequently, I’ve become Vice President of the Board and the liaison for all golf course related matters.

With 48 hours’ notice, we called a special Board meeting where we approved a special Homeowners Meeting to be held on February 28th. This special meeting will seek community approval to fund a contribution to a highly qualified, prospective golf course buyer. This contribution would allow him to immediate negotiate a cash deal and prompt closing first with MJS and then hopefully submit the deal to your office for final approval.

Although we are confident, there is no guarantee we will get a majority vote for approval of our Proxy. However, I wanted you to see, that with new HOA leadership in place, we are highly motivated to get back our golf course as soon as possible. We are also concerned that this transaction get consummated prior to our feared and pending Tax Deed sale or a foreclosure.

I will be sure to keep you up to date on our efforts.

Best Wishes,

Jim Hammond

Vice President – Plantation Palms HOA

—————————————————————————————————————————–

You will notice in my email to David Johnson that indicated our Special Membership meeting was scheduled for February 28th, the meeting was actually on February 25th.

You will also notice that I told David we would be voting on funding, this however got changed to a vote on the Tax Deed issue. More on that later!

- The Tax Deed Sale Issue – A Disaster Waiting to Happen

So much has been said about the pending Tax Deed sale of the Plantation Palms Golf Course property and now you are going to get the facts regarding it. As you can see by the February 2nd HOA board meeting notes we had 3 motions approved by the board, all subject to a special Membership Meeting and a vote by the community. One was for paying up to $150,000 for back taxes, voting on providing up to $800,000 to assist with the purchase of the golf course and a vote to see if people wanted a housing development.

Let’s just deal with the Tax Deed sale, what is it and how did it effect Plantation Palms Golf Club.

If someone in Florida does not pay their annual property tax the county may sell a “tax certificate” to an investor. This becomes a lien against the property, not the property owner. This way the county gets paid up front from an investor who will in-turn earn interest on the certificate. A bidder is actually bidding on an interest rate, the lowest interest rate wins, in case of a tie they use a random number generator to pick the winner. Bidding starts at the maximum of 18% interest and goes down from there. A tax certificate is an investment. This investment does not provide any property rights or ownership to the certificate holder. A certificate holder is an investor and the purpose of purchasing certificates is to earn interest on your investment not to get the property. Pasco County uses an on-line bidding system and conducts these auctions in May-June each year. Each unpaid tax year becomes a separate tax certificate available for bidding. Here is the on-line site that Pasco uses https://lienhub.com/county/pasco. If a property did not get any bids during this annual sale, it then becomes a “county held tax lien” and the tax certificate can be bought at any time during the year on another Pasco site. Here is a list of currently available “county certificates” on this web site https://pasco.lienexpress.net/certificates.

After a holder of a Tax Certificate has waited 2 years, as of April 1st of that year the investor may file an application for a Tax Deed, meaning that the investor will get his money back plus interest from the County. Any Tax Certificate that becomes 7 years old becomes worthless. If the person who originally owed the unpaid property taxes (or a mortgage company) pays off the past due taxes to the county, this payment to the county must include all the accrued interest and fees and the county will then pay-off the tax certificate investor.

Let’s assume the tax certificate holder wants to cash in on his investment and files an application to the county for a Tax Deed. Now the county is back in the same situation, unpaid property taxes for a number of years. The county may then auction off this property in a Tax Deed sale to the highest bidder. Seldom does the tax certificate holder bid on the actual property, he’s just an investor. However, other investors might be willing to bid on the property at a Tax Deed sale and take possession of the property for potentially a price slightly higher than what the county already has invested (the property tax, all the interest and handling fees). You could buy a $1M worth of property at auction for maybe thousands of dollars.

Plantation Palms Golf Course is actually comprised of 14 tax parcels. MJS DID NOT pay Pasco property taxes for 2012, 2013, 2014 or 2015. Basically, MJS never paid their property taxes since buying the course in April 2011. I assume they paid the 2011 property taxes for that year at the closing. It is sort of unbelievable that it went on this long and the bank never did anything about it, until they called the mortgage for non-payment, forcing a short-sale.

OK, so what did all of this mean to my efforts to find a golf course buyer? Back in the fall of 2015 the HOA attorney, Eric Appleton brought this to the attention of the HOA board. The issue was that tax certificate holders had started filing to get their money back, an application for a Tax Deed as early as June 2015 and a bunch more were file on November 6, 2015. Under the normal process, if the taxes weren’t paid by someone, these tax parcel properties would be auction to the highest bidder, regardless of the fact there was a $2.2 M mortgage attached to the. Here is a copy of the Tax Deed status as of February 2016, see all of the Tax Deed filings. Click here to view a copy. Based on information from the tax collector’s office I kept a running total of value of the tax certificates and tax deeds which would change monthly as interest was applied. Here is the last spreadsheet I had showing these amounts, click here to view. As you can see the Tax Deed portion was already $121,000 and the total including certificates was almost $150,000.

So, you would think the Bureau of Indian Affairs, their bank, or someone in the government would do something to make sure someone didn’t buy the golf course parcels just for the value of the tax deeds, at auction, roughly $150,000 plus some fees. Their $2.2M mortgage on the property would immediately become worthless. In the private sector this happens every day and the bank carrying the mortgage would just pay all the back and future property taxes just to protect their mortgage. But NOT the government. On January 21, 2016, Eric Appleton, on behalf of the HOA Board, sent a letter to David Johnson and others at the government bringing this serious issue to their attention. Click here to see a copy of that letter. So, what happened, the government just laughed it off and responded back that they had NO WAY to pay local property taxes. This was the “Ticking Time Bomb” I wrote to David Johnson about in my January 27th somewhat famous email!

What was our strategy? We wanted to get a deal done with a buyer for the golf course before ANY of the parcels were auctioned off! Plain and simple. But what would happened if we couldn’t get a deal done this fast? Bill Place had already made an offer to buy the course, contingent on the HOA providing some level of “participation” (money). But the deal was sitting in limbo and the Tax Deed clock was running. So, we developed a new strategy, a fallback position! We were going to ask the HOA community for permission to pay up to $150,000 in back taxes to the county if we had to protect a pending deal. This did not mean we were buying the property, or even buying the tax certificates directly. If we paid Pasco the amounts for the tax deeds that were going to auction, there would be no auction. This again was NOT something we wanted to do, but it was a fallback strategy. This explains the motion at the February 2, 2016 Organizational Board Meeting “to have a membership meeting and call for a vote to use up to $150,000 if necessary to pay the taxes on the golf course parcels.”. Now it should make sense to you.

Here is something never before revealed to the community! I did not want to take the time to call a special meeting for the tax deed approval. I wanted to instead call a special meeting vote on providing funds to help a buyer buy the golf course. I thought that if we pressed forward with the deal we could get if done before the tax deed sale ever took place. There was a lot of communications about this issue with various board members and others. I won’t provide names. In the end, I lost and we would go forward with the special meeting asking for $150,000, if necessary to pay taxes. Here is what you learn in these situations. Many times in my life I had executive meeting or attended board meetings were heated debates took place, each side was passionate in their beliefs, all were acting in good faith. Many times I was the ultimate decision maker, I wasn’t looking to be “the boss” and only do things my way. A good executive team or board is one that debates behind closed doors, but is united on the final vote that takes place. So it was here, in this case I was not “the boss” and I agreed to 100% back the request for tax deed money at the upcoming Membership meeting.

On February 25, 2016 the HOA board conducted a Special Membership meeting of the homeowners after having sent them a proxy to vote on the tax deed $150,000. For weeks before the meeting there was a huge divide within the community. Even though the BBOC block captains again went door to door handing out flyers supporting the tax deed funds, an equal number of opposing residents were handing out their own “vote no” flyers. Facebook was blasting the idea, it was one of the ugliest situations you could imagine. At the Members meeting alone over 20 residents spoke and voiced their opinions, many were angry and upset. In addition, the Reserve HOA had their attorney speak on behalf of the Reserve as a “no vote”. You could almost say that things were getting out of hand at the meeting.

Most did not understand the strategy, most thought the new HOA Board, including Simon and me were trying to rip them off. Our strategy however was that IF a golf course deal was eminent and approved by the government, the back taxes of $150,000 would have to be paid off by someone. Although I didn’t like the idea of this meeting, the strategy we had was not so bad. The HOA would pay the $150,000 and we would adjust this amount from whatever “community participation” we were willing to provide. A yes vote would have allowed the HOA, to at least have this flexibility. No way would the HOA pay the $150,000 without a guaranteed deal!!!

The meeting started at 7 PM and didn’t finish until almost 9 PM, the final vote was 265 NO and 196 Yes, a clear defeat! Here are the recorded minutes for that meeting. Here is a copy of the proxy that was sent to homeowners to vote on.

I haven’t told you the whole story of the February 25, 2018 meeting yet! But before I do, let me back track a few days and lay the ground work for the deal we were trying to put together with Bill Place.

- Getting a Services Agreement Deal Drafted – Deal & No Deal

As I mentioned many time already in book #2, I believed the only way to get a buyer to buy the golf courses was to help provide some community funds. The cost to rehab the course was more than the business was worth. But the issue was, EXACTLY how could our community do this, or even would our community vote to do this.

At this point in early February the HOA board had been in place for less than 2 weeks, we had a special community meeting coming up on February 25th, the proxy for the Tax Deed vote had been sent out and I was hard at work trying to structure a deal with Bill Place that would also be legal. My next HOA monthly board meeting was on Wednesday, February 17th and I wanted to have an agreement to present to the board for approval and call another special HOA community meeting to approve it.

On February 7, 2016 I sent a draft copy of “Value Proposition” to the HOA Board members for their review. This was my first attempt to justify providing about $800,000. This was a long list of things that we would ask for in trade for the funding. This list included some “must haves” such as right of first refusal to purchase the course if it were to close, but the list also had a lot of expensive costs to ACE Golf. I was proposing a “beautification” plan, street cleaning in the mornings etc. I won’t publish a copy of the Value Proposition, as you’ll see later we had legal issues.

I’ll let you read some of the emails around it.

————————————————————————————————————————–

Jim Hammond <jhammond48@yahoo.com>

To: HOA Board

Cc: eappleton@bushross.com

Feb 7, 2016 at 1:58 PM

Fellow Board Members,

With your help I have drafted a Value Proposition that I’ll present to Bill for his review. The idea is that if we go to the community and ask for money that we get back some “value” that would help justify the money.

Please review these items. I arbitrarily plugged in a costs for these, but again this is all a first draft and Bill hasn’t seen it.

After I receive your feedback I’ll send it to him for a discussion. After we negotiate the general ideas we can have Eric draft a more formal agreement.

Jim Hammond

————————————————————————————————————————-

Jim Hammond <jhammond48@yahoo.com>

To: Bill Place

Feb 10, 2016 at 9:32 AM

Bill,

I’ve been working with our Board to find a way to justify providing you assistance in opening our golf course. All of our residents want the golf course back and run by a professional organization, like yours. Most, but not all, believe a benefit of the open course is the improvement in our property values. Some have pointed out studies including Crescent Oaks that show little improvement in per sq ft selling prices before and after the closed course opened, others believe this only effects the people selling in the next few years. The HOA Board believes that your purchase and opening of our golf course will both protect and increase our property values.

In order to ask our community to provide a financial aid to a private buyer we need to be able to show them “value for the aid”, what are they getting for their money. Along this thought I’m attaching a draft Value Proposition for your review. Let me know a good time we can discuss this.

Thanks,

Jim Hammond

——————————————————————————————————————————–

Bill Place

To: jhammond48@yahoo.com

Feb 11, 2016 at 8:50 AM

Jim,

I’ve made some notes on your attachments. These are subject to a review by my attorney if we come to agreement.

As you know, I was prepared to withdraw my offer for the course when I learned that it was unlikely that the driving range parcel could be used to raise renovation capital. At that point, Mr. Gunsteens asked me what would make the acquisition viable, and I gave my response which is the purchase and renovation supplement that you have outlined.

Purchase and renovation of the Plantation Palms Golf Course is a long-term project with a higher degree of risk than most golf course acquisitions. The numbers simply do not work when a lot of additional risks and costs are added to the proposal that I made to the HOA.

- The club was losing over $200,000/year in 2009 when it was sold. It did not make any money during the MJS years. And, I don’t know if it ever really made money since its construction in 2000.

- The club has been closed for almost two years, adding immensely to the renovation cost and to the cash flow requirements to getting it back open and getting golfers to return. It will take a good 3-4 years to condition the course back to optimal playing conditions, and during this time it will be difficult to fill tee sheets to a profitable level.

- There are some major investments required to change the business model to one that ensures long-term health of the club. I have outlined these clubhouse and other improvements to you previously.

I know what it will take to make this club successful. It requires much more investment and carries far more risk than our three golf course renovations to date. And, the relatively high ongoing golf course maintenance and improvement costs do not give a lot of room to assume extra maintenance and other costs.

I also understand and appreciate why residents are wanting to see their money handled responsibly. While I think this club can and should be a successful and vibrant part of the community, I will not agree to further costs and restrictions that might doom it yet again.

Sincerely,

Bill Place – President, Ace Golf

—————————————————————————————————————————-

Jim Hammond <jhammond48@yahoo.com>

To: Bill Place

Feb 11, 2016 at 8:53 AM

Bill,

I have taxes till 2pm today. Can we talk this afternoon?

Jim

————————————————————————————————————————-

I did speak to Bill on the afternoon of Thursday, February 11th. I would say that we were both looking for a way to structure a deal, but we just weren’t able to come to a common structure of what Plantation Palms would get that would justify the funding, other than he would buy the course and rehab it. Although this was important, I couldn’t take this to the community.

I needed to brief the other board members, and because of Florida sunshine laws I had to do this briefing in small groups. Therefore, on Friday, February 12th I met with Tim and Keith at Panera Bread. On Monday, February 15th I met with Ray and Jeff at noon, and the next day I had lunch with Laurann at Panera Bread. Later that afternoon, on Tuesday February 16th we had a conference call scheduled with Eric Appleton and Bill Place to have a frank discussion on what we could and couldn’t do.

That February 16th 3:30 PM conference call DID NOT go well. The bottom line was that we had legal issues with everything I had been proposing! Within an hour the entire deal had fallen apart, there was NO WAY we could use the “Value Proposition” concept to provide Ace Golf with funding. We ended the call on a friendly tone, but the entire deal fell apart.

Bill Place proceeded to text Rob Rochlin that he was cancelling his offer to buy the course. Rob called me completely pissed off, I was in no mood to listen to him or any one else. All of this work with ACE Golf had just gone down the drain. There was NO DEAL. I don’t remember how I slept that night but I know that I woke up Wednesday morning, February 17th I had a whole new idea, how could I have missed this before. I was trying the wrong approach. It dawned on me, what was the single biggest challenge any business has after being closed for 2 years when it re-opens? CUSTOMERS! Of course, a new business needs lots and lots of customers as soon as possible.

This vision had to be a gift from above. I just needed to structure a deal to give Bill Place a lot of guaranteed customers, like 821 new customers. All morning long I was on the phone with either Bill Place or Eric Appleton. The new idea was so simple, Plantation Palms would buy golf club memberships for all 821 homeowners. I had researched a similar concept earlier to see how legal this was and found that a lot of HOA’s purchased annual memberships to swimming facilities, on-site health clubs and yes even golf clubs. Many of these facilities had some sort of HOA ownership, but that was not a requirement.

By 3 PM on February 17th Bill and I were pretty close to deal for a “Services Agreement”, at least in concept. Bill was also being very accommodating and came off his $800,000 requirement, we were now talking about $625,000 over 5 years. I told Bill that if we could reach a verbal agreement on the specific details I would take it to the 6:30 PM board meeting that night and seek full board approval and authorization for another special HOA Membership Meeting to vote on it.

At 5:30 PM, just an hour before the board meeting Bill called to say “We Have a Deal”!

At 6:30 PM, we opened the official February HOA Board meeting. I made a motion to provide Ace Golf $625,000 over 5 years for a Services Agreement and to authorize a community vote. The motion was unanimously approved! I needed a drink!!!

Over the next several weeks we had a lot of work to do to negotiate all the details of the Services Agreement, schedule a community vote for early March, and oh by the way figure out how we were going to get the community to approve $625,000!!!

We also had to see where the government was in the foreclosure process.

- Guess Who Comes Back Into The Picture?

Rocky Morgan, Dusty Dean and Rocky’s Attorney are now contacting the government directly trying to get back into this deal. I needed to make sure we were on top of exactly what they were doing.

———————————————————————————————————————

Jim Hammond <jhammond48@yahoo.com>

To: Rocky Morgan

Feb 9, 2016 at 11:40 AM

Hi Rocky,

I understand from the gov’t that you have shown interest in the golf course again.

Jim-

———————————————————————————————————————

Rock A. Morgan

To: jhammond48@yahoo.com

Cc: Rocky Attorney@lawfirm.com

Feb 9, 2016 at 1:02 PM

Jim,

If you will recall my commitment to you and that community was not to walk away. I never did. Now…..we are going to do what should of happened back in October of last year. Other than the Tour portion, Dusty is not involved in this acquisition. This time (Rocky attorney) will take the lead from the beginning and proper funding is in place. We don’t have to rely on the property maintenance contracts going in.

I believe in my heart that you want what is best for Plantation Palms and have worked to make that happen. I will stand before God and PP and say that again. All you did was try to help me help them.

Hope all is well.

Rock

——————————————————————————————————————————-

Rocky Morgan

To: jhammond48@yahoo.com

Feb 9, 2016 at 8:59 PM

Jim…..please know that (Rocky Attorney) is on top of that and in direct contact with the seller’s agent and the BIA. Mr Johnson and Mr Berryhill have been fantastic. This message better self-destruct after you read it.

——————————————————————————————————————————

Rock A. Morgan

To: jhammond48@yahoo.com

Feb 16, 2016 at 8:03 PM

Jim,

We just finished with DelMorgan. Based on the information from DelMorgan, (Rocky Attorney) is preparing the LOI to present to the sellers. If the sellers and the BIA and the tax deed folks will work with us and our timeline we can get this thing done with a fair offer. The offer still has to be accepted and approved.

We also have the money approved for another portfolio of courses that is on the market that you are familiar with. If Plantation Palms does not materialize for us we will still be in the area.

Rock

——————————————————————————————————————————

Rocky Attorney <xxxxxxxxxxxxx@lawfirm.com>

To: jhammond48@yahoo.com

Feb 22, 2016 at 6:36 PM

Mr. Hammond –